Reduce Expenses, Increase Efficiencies With DD Check Processing Solution

For insurers, utilities, nonprofits, government agencies, and other billers seeking a solution to the costs...

Manual check processing can be a complicated and costly part of any business, leading to wasted time and effort. The solution? Outsource your check processing needs to Data Dimensions, which is positioned to deal with them efficiently and cost-effectively through its Check 21 processing solution.

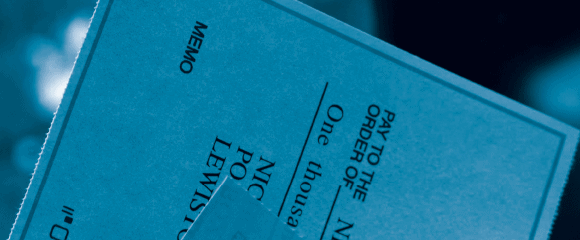

In this solution, your organization’s checks are captured and instantly displayed either through a secure web-based or on-premise image repository. Paper checks are scanned, all necessary fields (date, amount, MICR information, etc.) are automatically captured, and the images and data are sent to Data Dimensions’ highly secure image repository, where they are stored and made available to authorized employees and customers for viewing. The information then is validated, and the electronic file is transmitted for settlement or deposit processing.

The benefits of using Data Dimensions’ Check 21 solution include:

If you’re tired of struggling with the expense and complexities of check processing, free your organization by letting Data Dimension deal with those problems with its Check 21 solution.

Subscribe to get fresh news and resources delivered straight to your inbox.